Discover how Android enables merchants to benefit from the digital experience. Our expert, Nicolas Cousinard, Android Product Manager, explains how Android is making traditional cash registers history!

Android is imposing itself in the industry of payments. How would you explain this trend and its fast adoption?

This technology is more than 12-year-old (which is centuries in the mobile industry) and has displaced all other existing operating system except Apple’s iOS. It represents more than two thirds of the smartphones market since 2016*. It has spread outside telecom to reach consumer products like home appliances (TV sets, set-top-boxes), personal computing, IOT, automotive and moved to payment industry.

Being open source and supported by large manufacturers supplying products by the hundreds of millions are certainly the key of its success.

Yet the payments industry is more traditional and conservative, and Android made its entry much later, in 2016.

Originally, payment terminals were designed with proprietary embedded OS. Progressively, connectivity and different peripherals such as Bluetooth, cameras and GPS were added to improve the merchant experience. With this, the industry moved towards Linux OS, which facilitated the integration of technology through community-developed software, but at that time the user interface was still developed in-house by payment technology companies.

With Android, we progress a step further, getting best-in-class technology on a platform that is user-friendly, already widely used by consumers and regularly updated to the latest design trends.

Also, the rise of new payment methods, like the QR code and the growing demand for digital devices that can support a variety of commerce use cases (e.g. ECR, ticketing, menu ordering, loyalty, inventory, financial services, etc...) explains this demand.

In addition, Android is popular in app developer community. Java is the #1 language** and Kotlin is growing. This in turn makes it easy and cost effective to develop applications for the platform.

We estimate Android penetration in the payment acceptance to reach 34% by 2022. It’s clear that the Android trend is here to stay!

Is Android ECR the answer for merchants who require the same level of digitalisation retailers have, and tailored to their needs?

SMB merchants require one single solution that can manage their entire business, answering their different business situations and environments.

With the right software, SMBs can have access to many professional business apps crafted for their own use or their market segment, allowing them to run their business whenever and wherever they want.

With these requirements, an Android device terminal is the perfect fit to run ECR applications, providing all functionalities a merchant needs (basket management, stock, employee schedule, online store, etc.), not only on their till, but on a wide variety of other form factors as well: from smartphone-type devices to larger tablets to meet a variety of day-to-day activities.

Android is also growing in the ECR market because it allows software vendors to develop a single responsive app which can run on different devices (payment terminals, smartphones a/o tablets).

New habits in the retail industry such as order online and pay in store, Click-n-Collect, … require brick & mortar shops to become the extension of the online world … or vice versa, online world being the extension of brick and mortar. This requires shop attendant to interact with cloud-based applications as well as manage in-store sales.

Having an Android payment terminal, such as an APOS A8, combined with an AECR, is highly beneficial in mobility use-cases, like for restaurants. Indeed, merchants can benefit from the same rich user experience on their portable payment terminal, whether the move in the shop or outside.

How does a business-grade solution be different from a consumer-grade tablet?

Some customers have stringent QA or extensive testing and don’t expect too many frequent changes. On the contrary, some others expect up-to-date products with the most recent Android version. This is very different from the consumer market.

Common ground is found on the fact that all require long-term support to be sure that their investment will last. This is the case for software support, supply and spare parts usually expected to last 3 to 5 years after the end of life notice.

As a vendor, we provide solutions for merchants, software vendors and the banks. Each one has very specific needs related to the device (contactless payment card readers, printer integration, Secure Access Module, mechanical and security hardening). In such case, professional devices are preferred to commercial-off-the-shelf consumer devices.

How do you address merchants’ needs and maintain their loyalty to your POS?

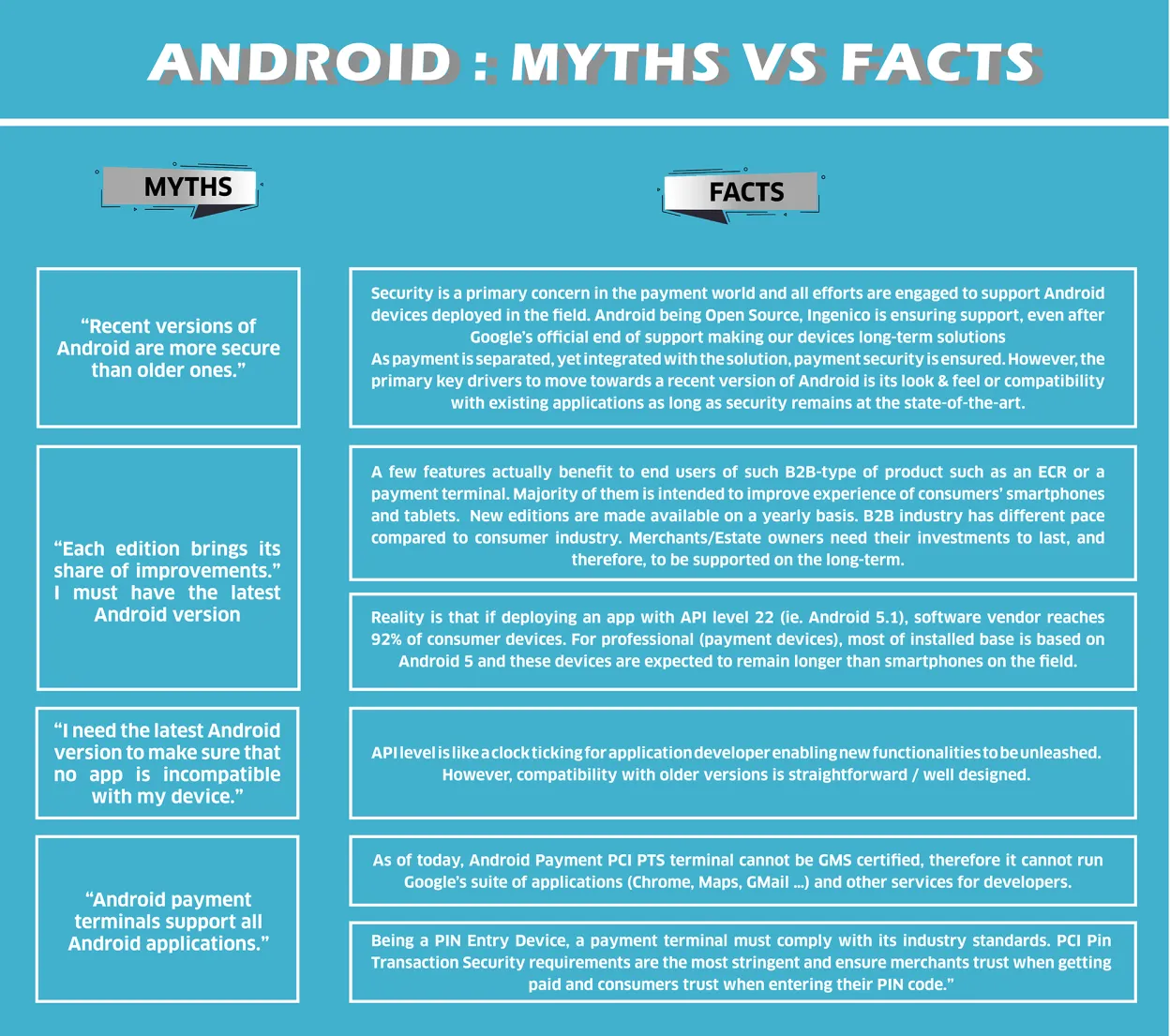

Maintaining the highest level of security is key to ensuring a merchant’s business runs safely. Ingenico has a long-standing experience in security which benefits the cash register (find more on “Myth vs Facts” side bar story).

However, for the software vendors, as payment is complex due to the combination of international brands and local schemes as well as the approval from the acquirers, they need a payment solution that can accept all payment methods, ensuring merchants won’t miss a sale. This solution has to be easy to integrate to minimise costs as well as cross borders to fuel their growth. Global API and cloud-based solution enable this seamless integration.

And from estate owners’ perspective, they need a perfectly designed estate management as operating cash registers and payment terminals in the field cannot be minimised. Indeed, if not properly designed, estate management can become costly, especially when supporting merchant on-site or swapping devices. Such solutions include software updates, parameter updates and remote diagnostics.

Last but not least, to maintain merchants’ loyalty towards their POS, both the cloud solution and hardware devices must be always operational. This is a must, and our Customer Care team is key to ensuring day-to-day satisfaction for merchants with services like our first line support or recycling and replacement services.

What’s in it for banks? And what’s in it for software vendors?

We provide a complete solution, supporting ISV and Banks & Acquirers, to successfully address merchants’ needs.

Ingenico is ready to create new business models that enable new partnerships between banks, acquirers and software vendors to support ISV growth and help banks offer more services and retain their customers or gain new ones.

This enables 3-party partnerships where:

- Ingenico, supplies an Android ECR bundled with a payment terminal with associated management solutions and services.

- Software vendors extends their offer with different form factors of professional devices to merchants from global and single APIs.

- Finally, banks and acquirers enrich their offer and find a way to resist new entrants offering all-in-one solutions.

Our local presence (as vendor) and experience in payment and professional devices makes this business model beneficial for all.