How Tap to Pay Will Change the Payments Landscape

Listen to this article

Canadian consumers have enthusiastically embraced payments from their mobile devices. Interac data shows mobile debit transactions increased 53% year over year from 2022 to 2023 as Canadians used their smartphones and smartwatches more often to make contactless payments via mobile wallets. This trend has gained momentum over several years, and signs point to it continuing. Mordor Intelligence research found the pandemic drove Canadians to avoid handling currency while moving to use their mobile wallets. The volume of these transactions increased by 13% in 2020 alone. Furthermore, 42% of Canadians believe they’ll continue to prefer contactless payment methods moving forward, which is driving the adoption of another technology: Tap to Pay.

What is Tap to Pay?

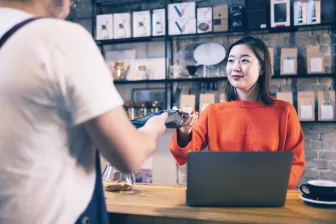

Tap to Pay payment technology allows merchants to accept payments directly on their smartphone. No payment terminal or PIN pad is necessary. It leverages near-field communication (NFC) built into smartphones to enable communication between the consumer’s mobile wallet or contactless payment card and the merchant’s smartphone for the payment.

This new payment service is secure. Tap to Pay mobile solutions must comply with Payment Card Industry (PCI) Mobile Payments on Commercial-Off-the-Shelf (MPoC) security standards by the same standards body that governs traditional payment terminals and infrastructure. Cardholder data is protected. Tap to Pay also uses the same payment infrastructure as traditional EMV card payment transactions.

To accept payments, the merchant downloads a specialized app and, after approval from the provider, the system is secured and the merchant can begin taking transactions, often within minutes. Tap to Pay mobile technology is processor-agnostic, so merchants can choose the payment processing solution that provides them with the functionality they need and the optimal fee structure for their business.

The Benefits of Disruptive Tap to Pay Mobile Technology

Although other technologies have professed to be industry disruptors, tap to pay will achieve it. Without the need for a payment terminal or a purposeful payment device, merchants will be free to accept payments anywhere using smartphones, which they already own.

Large and enterprise retailers can also craft new experiences, accepting payments wherever they engage customers. They can set up additional lanes during peak traffic times or use their smartphones for line busting. Retailers can quickly assist buy-online-pickup-in-store (BOPIS) customers who want to purchase additional items once they arrive. This solution can easily manage sales at a pop-up store or sidewalk sale. Tap to Pay also provides a seamless failover if merchants experience network disruption and can’t accept payments with their countertop devices.

However, Tap to Pay is likely to have a bigger impact on smaller merchants. Without the need to deploy new payment devices, merchants can expand their capabilities and level the playing field with larger competitors. They will no longer have to require customers to line up at a checkout counter to accept contactless payments. They can accept them throughout the store, streamlining processes and enhancing buyers’ journeys.

Tap to Pay also brings digital payment acceptance capabilities to micro-merchants who may not have had the option. Rideshare drivers, food stand or food truck owners, festival concession providers, and home repair contractors can use their phones to accept contactless payments. Meeting consumer expectations for payment choice may help them build loyalty while allowing them to operate more efficiently and with less risk of losses.

Just How Fast Will Tap to Pay Mobile Payments Grow?

Fortune Business Insights predicts the global tap on mobile market, aka the “soft POS” market, will increase from more than CAD $340.19 million in 2022 to over CAD $1474.9 million in 2030, a phenomenal 20.4% compound annual growth rate (CAGR).

The growth in the market indicates tap on mobile may become a competitive differentiator. Consumers who prefer to make contactless card and mobile wallet payments for health, safety or convenience will find merchants who accept them. Tap to Pay will allow more merchants to compete by offering the experiences their customers demand.

Contact us today to learn how Phos by Ingenico can turn Android smartphones into payment devices.