If Canadians’ contactless payment adoption is any indicator, retailers of all sizes need to take a serious look at adding softPOS to their payment capabilities. Chase Canada research for its 2023 State of Canadian Payments report found consumers use contactless payment cards in 41% of transactions, and the payment method has experienced a phenomenal 37% growth year over year. Factor in smartphone penetration across the country, which is now over 88%, and 53% of consumers with mobile wallets use this form of payment more often than in 2022.

With consumers clearly preferring this payment method, merchants need to accept contactless payments to meet their expectations. However, only about 38% of businesses have the technology that accommodates them. Chase Canada reports of the 62% of business owners that don’t currently accept contactless payments, 58% have a “strong desire” to upgrade their technology to add this option at the checkout. So, what’s the next move?

The SoftPOS Solution

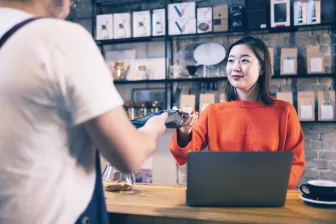

SoftPOS, also, known as “tap on mobile”, “tap on phone” or Tap to Pay gives merchants a way to accept contactless payments with minimal investment and implementation time. The most current SoftPOS solutions have overcome challenges associated with this technology in the past. The Payment Card Industry Security Standards Council (PCI SSC), published the Mobile Payment on Consumer Off-the-Shelf (MPoC) standard in 2022, giving developers more flexibility in how they could create, deploy, and maintain these solutions. MPoC also included security standards for PIN entry on the same device that captures cardholder data, streamlining transaction processes.

However, Tap to Pay is a compelling choice for another reason: Merchants don’t have to invest in specialized payment devices to accept contactless payments. They can accept payments with smartphones, tablets, or other devices they already own, provided they have operating systems compatible with the SoftPOS solution. They also don’t need to find the time and resources to manage and update new payment devices and train employees on another piece of hardware. Additionally, merchants will most likely find their payment processors support this payment method, and they can begin accepting payments within minutes.

Which Merchants Benefit from SoftPOS?

Micro-merchants, like food truck operators, farm stand proprietors, and hairstylists, can expand their payment acceptance capabilities immediately. They can evolve from cash-only businesses or sending invoices to accepting contactless payments on their mobile devices. The experience for their customers – and for their businesses – immediately improves. Customers are no longer limited to the cash on hand, which can lead to larger purchase amounts. Additionally, service providers, such as landscapers or home repair contractors, can accept payments when work is completed, eliminating the need to invoice and wait for payment.

However, Tap to Pay isn’t just a small-business solution. It also offers value to large merchants and enterprises. Tap to Pay allows their employees to accept contactless payments anywhere: in the aisles, at the fitting room, curbside, or at the restaurant table. It’s the perfect complement to the payment technology they use on the counter, enabling on-the-spot contactless transactions and keeping checkout lines short and customers happy.

Don’t Wait

The key takeaway for retailers and solutions providers who have taken a wait-and-see approach to expanding their payment capabilities is clear: The wait is over. It’s time to meet consumer demands to use contactless payments everywhere they make purchases and to keep up with the competition in delivering those experiences. SoftPOS makes contactless payment acceptance easy and cost-effective for businesses of all sizes – and it may even be possible to begin accepting tap-to-mobile payments today.

Contact us to learn more about how SoftPOS will benefit your business.