Contactless transactions have seen huge growth in Europe in the last couple of years, but the pace of progression to digital payments is unique to each nation. Continuing our journey across Europe, we hear from Paolo Temporiti, country manager for Italy at Ingenico, who examines the latest contactless trends in the cash dominated Italian market.

Italy loves cash. It dominates the day to day running of the economy, and while other countries have embraced digital and card payments, Italy remains attached to coins and banknotes.

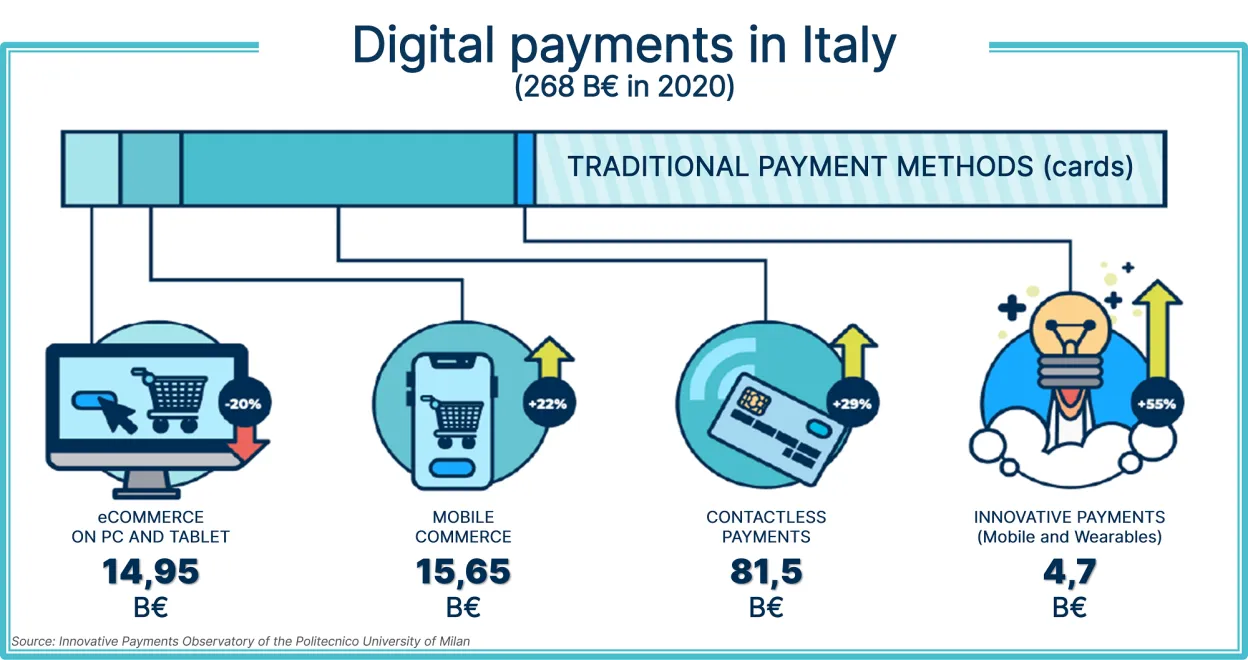

But, like elsewhere, the global pandemic has had a major impact on payments, resulting in a dramatic boost in the use of e-money. Contactless transactions have increased, government initiatives have been introduced to boost card usage, e-commerce has grown significantly, and we have seen double digit growth in the use of mobile and wearable device transactions.

Italy’s journey has been very similar to that travelled by other countries across Europe, and we are still experiencing the tail winds, even in 2021. But the increased acceleration away from cash dominance has been one of the few positives to come out of a very difficult situation.

Smartphones and wearables are driving digital growth

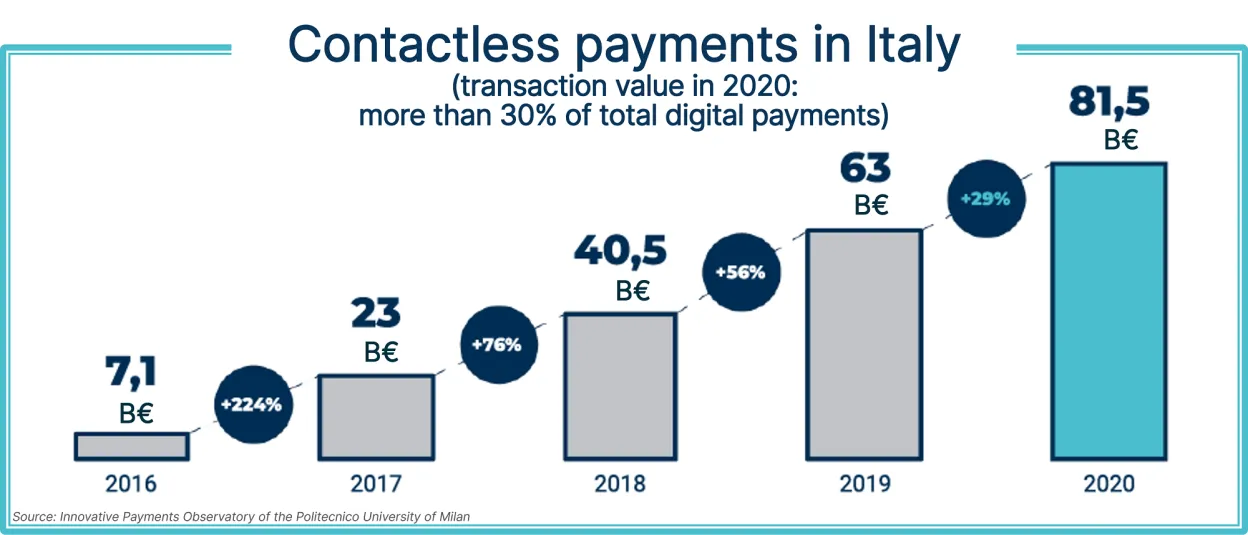

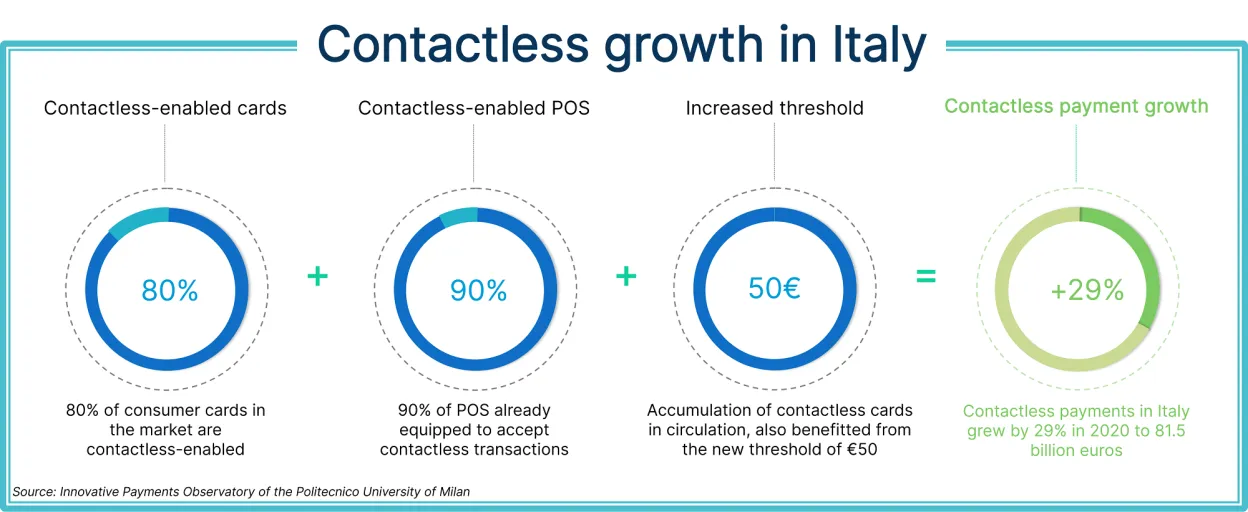

Contactless payments in Italy grew by 29% in 2020 to 81.5 billion euros, of which smartphones and wearables accounted for an impressive 3.4 billion, an increase of 80%. This growth, supported by the accumulation of contactless cards in circulation, also benefitted from the new threshold of €50.

Contactless methods became popular with citizens keen to avoid the spread of infection by Covid-19, and this new preference for ‘tap and go’ solutions helped to support the uptake. The payment industry was well prepared for this significant change in consumer behaviour, with over 90% of POS already equipped to accept contactless transactions.

Despite a general decline in consumption of over 13%, digital payments in Italy in 2020 reached 5.2 billion transactions, rising from 29% to 33% of the total value of national payments1. This represents 268 billion euros and increasing penetration in respect to cash, though this remains the dominant form. The Bank of Italy estimates that there were 2,000 transactions per POS per year in 2020 with an average of just 6.7 per day.

The constantly connected consumer

Whilst the journey to digital payments still has a long way to go, consumers in Italy are starting to make purchases in different ways, using both offline and online tools with an approach that can sometimes surprise sellers, especially through the use of smartphones. The Politecnico University of Milan estimates that more than 50% of online purchases are now started by personal smartphones. But most stores were ‘digital-ready’ even before the pandemic, even if consumer behaviours have only taken this new direction in recent times.

The increased use of digital tools is also confirmed by a Netcomm study2 in Italy which showed that during the pandemic, 13% of digital users started and completed their purchase process online compared to 2% the previous year: a strong signal for all merchants who have “physical” stores.

Smart digital payment is driving demand

The payments industry in Italy is perceived as a commoditised business, which has forced big operators, and newcomers, to focus on innovation. And to drive and bring improvements to market, merchants need to leverage smart devices, value added services, apps… whatever brings more value to the payment transaction.

Italy has started to surf this technology wave, and whilst we are not leading the innovation race, there are increasingly positive signs that good progress is being made.

This is illustrated by the emergence of new formats, including omnichannel and click and collect, which saw growth of 20% in the Food and Grocery sector in 2020. Discount stores and small retailers started working on ecommerce platforms for the first time, and the use of mobile terminals grew supporting new delivery services, helping to provide the best operational support for customers.

The road to cashless is set

Italy may have longer to travel on its digital journey away from cash, but the movement is accelerating. A great example of the innovation needed to support this was the launch of the first contact-free store which opened recently in Milan, accepting only cashless payments. This would have been hard to envisage even only a couple of years ago and is important progress.

Despite Italy’s conservative approach to money, the transition from physical to digital is clearly taking place and the growth in contactless usage will help to establish it as a favourite with customers. We need to build on this increased confidence and maintain the momentum for the cashless revolution to take a firm hold.

As the value proposition of cashless payments grows stronger, Ingenico remains at the forefront of contactless innovation, supporting its customers with the payment technology they will need to meet the evolving needs of Italian consumers.