For any business, a seamless and nearly invisible payment process is the final checkpoint of a positive customer experience. However, while consumers in the U.S. are getting more comfortable with using chip cards in a variety of verticals—including retail, hotel, lodging and the food and beverage industry—there’s still a fair amount of confusion about when to dip the chip and when to swipe. Many consumers are getting used to it but are still frustrated with the perceived speed of an EMV transaction.

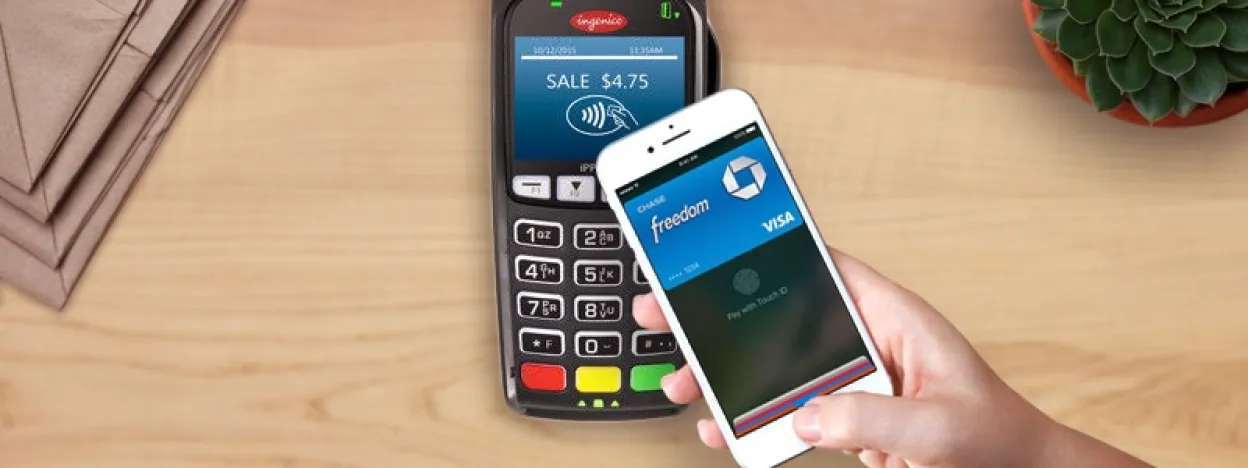

One way merchants can provide customers with a quicker, more consistent payment process is accepting NFC-based mobile payments, such as Apple Pay, Google Pay and Samsung Pay. These apps allow consumers to make payments quickly and securely, and they provide merchants with additional ways to engage their customers.

Advantages of accepting mobile wallets

Ultimately, all merchants should aim to provide customers with all available options for card-based payment, including mobile wallets. Accepting mobile wallets has many benefits. These include:

- Quick Checkout: Mobile wallets are very quick and easy to use. Once the terminal or mPOS device prompts the customer for payment, all they need to do is get their smartphone near it and use that device to authenticate. Payment information is securely transferred wirelessly to the terminal or mPOS device, which processes the payment. This can help improve checkout efficiency for stores during busy times and give them opportunities to serve more customers and better engage with them.

- Security: Mobile wallets are secure payment methods and simplify the acceptance of EMV payments for merchants. Mobile wallets use high levels of encryption and tokenization that help protect cardholder information better than physical cards.

- Loyalty: Merchants can also integrate loyalty programs in their mobile wallet acceptance solutions, allowing them to attract repeat visitors. Apple Pay, for example, has launched support for loyalty cards across different sectors, including restaurants, to encourage more people to use their phone to pay.

- Brand Image: In addition to being secure, mobile wallets can make the merchant look more tech savvy. This can help enhance brand image in the eyes of the consumer.

Selecting the right option for your business

We often get asked by merchants whether they should accept one mobile wallet over another, or if there are any advantages of accepting Apple Pay over Samsung Pay, etc. Ideally, a merchant should be able to accept all mobile payment services. This ensures that all customers are able to pay as they prefer, regardless of their smartphone platform.

Another important thing to keep in mind is that, while only one-third of smartphone users have used a mobile wallet on their device, consumer adoption will continue to rise as more businesses continue to make the option available. At some point, merchants will need to accept all mobile wallets to meet consumer expectations and preferences, so why not get a head start?

However, if you’re unable to accept all mobile wallets for a particular reason, it’s best to look at your customers’ shopping preferences before choosing which service or services are best for you. For example, if the majority of your customers use iPhones, it’s probably a safe bet to prioritize accepting Apple Pay versus Google Pay or Samsung Pay.

NFC options are more than just payment

While NFC-based mobile payments provide a more seamless checkout experience, they offer other added benefits as well. As mobile payment applications have matured, solution providers such as Apple, Google and Samsung have begun to add additional value-added service (VAS) capabilities to make their solutions more enticing for businesses.

For example, businesses can integrate their own loyalty programs and couponing services into these mobile payment solutions to provide further value to their customers. This can help drive loyalty and more impulse purchases because deals can be pushed to customers on their devices rather than promoting them through other, more expensive channels.

DIY – Is it worth it to create your own?

You may have noticed that companies like Starbucks, Walmart and Target have all created their own mobile payment applications. While they have been successful thus far, this is not necessarily the right step for your business. These three companies have massive audiences and followings from consumers who already use their existing mobile applications, which makes integrating a payment component into their apps a relatively easy adjustment for these merchants and their customers. Building your own mobile wallet offers potential benefits, but it comes with a fair share of challenges that not all merchants may be able to manage.

Something to consider is that applications such as Apple Pay, Google Pay and Samsung Pay cover most potential users and come pre-installed on consumers’ devices. Additionally, because they can be used at a variety of different businesses, it’s easier for consumers to justify adopting them over downloading your specific application and providing their payment information.

Overall, whether you’ve decided to start accepting NFC-based mobile payments or are still considering it, the strategy can definitely help improve your customer’s experience. If you are interested, but still have questions, feel free to either leave us a comment or reach out directly and we’ll help you figure out if NFC-based mobile payments are right for your business.

Nate Potter is Director of Retail Strategy at Ingenico Group, North America