ALTERNATIVE IDEAS - Helping retailers to cash in on the increasing number of payment methods available around the world.

What it means and how PPaaS, Payments Platform as a Service can help.

Around the world there is an ever-growing number of so-called alternative payment methods (APMs) catering to different markets and segments. Some reports put the total at around 200, others say 450, and yet others go as high as 900. Whatever the actual figure, it’s true to say that not only is the number of payment methods growing but so is uptake.

Take digital and mobile wallets: last year, Capgemini’s latest World Payments Report 2021 found that nearly 45 percent of consumers were frequently using mobile wallets to make payments, almost double the 23 percent recorded in the previous year’s poll. “As digital payments and mobile wallets become more the norm than the exception, payment providers must find ways to meet consumer hopes for speed and ease of use,” said Anirban Bose, CEO of Capgemini’s Financial Services.

The majority of APMs cater primarily to the online sector, but when consumers hit the mall, they’re also looking for similar speed and ease of use. And that means they’re likely to want to find the same payment method they’re used to using online. A 2021 report by Blackhawk Network, an American gift card company, found that 63 percent of respondents in a survey were more likely to shop at a retailer if it accepted the digital payment methods they use online. In the same survey, 73 percent said they wanted a seamless omnichannel experience, paying the same way whether it’s online or instore.

For the more than 1.2 billion users of Alipay, for example, it might come as a surprise to be told that their favoured payment method is considered somehow ‘alternative’! The same could be said for the 300,000 merchants in the Nordics who are currently being brought together by a merger of mobile wallets MobilePay, Pivo and Vipps: your alternative is my preference.

Apple Pay is a perfect example: It’s becoming a more predominant payment method than cards, but it’s still called an APM.

Perhaps aware of the issues with the word ‘alternative’, many acquirers and payment services providers have instead begun referring to ‘new’ payment methods, meaning anything other than the traditional card and which starts to get traction. But that still neglects the likes of Alipay and WeChat Pay, which have been operating successfully for many years.

So perhaps its best simply to think broadly in terms of different families of payment methods, whether that means cards, QR codes, Pay by Bank or whatever – and not to think of any one method as being necessarily better than the others. To each according to his needs…

In China in particular, the trend is long established, whereas in more traditional, card-using regions, QR codes tend to be more of interest to a younger generation of consumers.

As well as being accelerated by the pandemic, growth is coming partly from the emergence of another trend: a move from pull payments to push payments. This is a good way to look at the difference between the two methods. If you use a credit or debit card in a terminal, it's like the merchant is pulling the money out of your card; but reading the merchant’s QR code on your cell phone is more like pushing your payment to the merchant.

As global leisure travel begins to return to pre-pandemic levels, there are obvious advantages for merchants who can cater to foreign tourists who want to use QR code payment apps such as Alipay or WeChat Pay on their holidays abroad. And as QR codes begin to gain traction among younger consumers, it’s in the interests of retailers to offer that option.

These new payment methods are becoming a new way of segmenting the market. In the early days of card payments, the first card, Diners, segmented the market for businesspeople in New York. Restaurants that accepted Diners got more of the business lunch market than others. And were paid a commission for the privilege. And as card payments developed over the years, they progressively sliced and diced the market on the issuing side to capture different segments, with acceptance being – after a while – pretty much universal.

But the new payment methods – which cater to new segments of the market – need acceptance at the point of sale also, and that, traditionally, has been complex.

How does PPaaS help?

PPaaS can facilitate this without the need for complex development and software updates.

Thanks to the thin client technology that PPaaS brings to the terminal and the centralised architecture of the platform, it’s easy and quick to deploy a new payment method from the PPaaS portal that’s relevant for a specific demographic, a specific geography, a specific acquirer or a specific merchant.

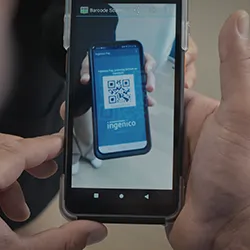

When it comes to QR codes, consumers can be offered two ways of completing a transaction with PPaaS: either by scanning a code displayed on the terminal or by showing the code on their mobile phone, which is then scanned by the terminal. And the same ease and speed apply to other payment methods: PPaaS provides a comprehensive range of APMs for instore payments, with easy access for developers to connect to the platform through APIs and plugins.

In the burgeoning world of APMs, PPaaS is revolutionising the instore experience, bringing more payment options for customers and in many cases bringing instore what has up to now only been possible online.

If you’d like to know more about PPaaS or would like to request a demo, contact us.