Having historically been a country deeply tied to cash, and after years of slow growth, today the latest digital payment methods have become popular among Italian consumers. Paolo Temporiti, Head of Italy, CESEE & Middle East at Ingenico, explores the data and shares his vision for the future of payments in Italy.

The growth of digital payments that we are seeing in Italy is more than a rebound from the covid pandemic. We have reached a position where cashless payments have become part of daily life for Italians – with consumer behaviour having been altered permanently.

This was one of the key messages shared at the recent conference "Innovative Payments: don't look back". Organised by the Innovative Payments Observatory at Politecnico in Milano, the main focus of discussion was Italy’s digital payment growth. Data presented at the event, which I share here, is eye opening, representing a significant transformation. I would like to reflect on some of the major changes we have seen and consider what is next for payments in Italy.

The growth of digital payments in Italy

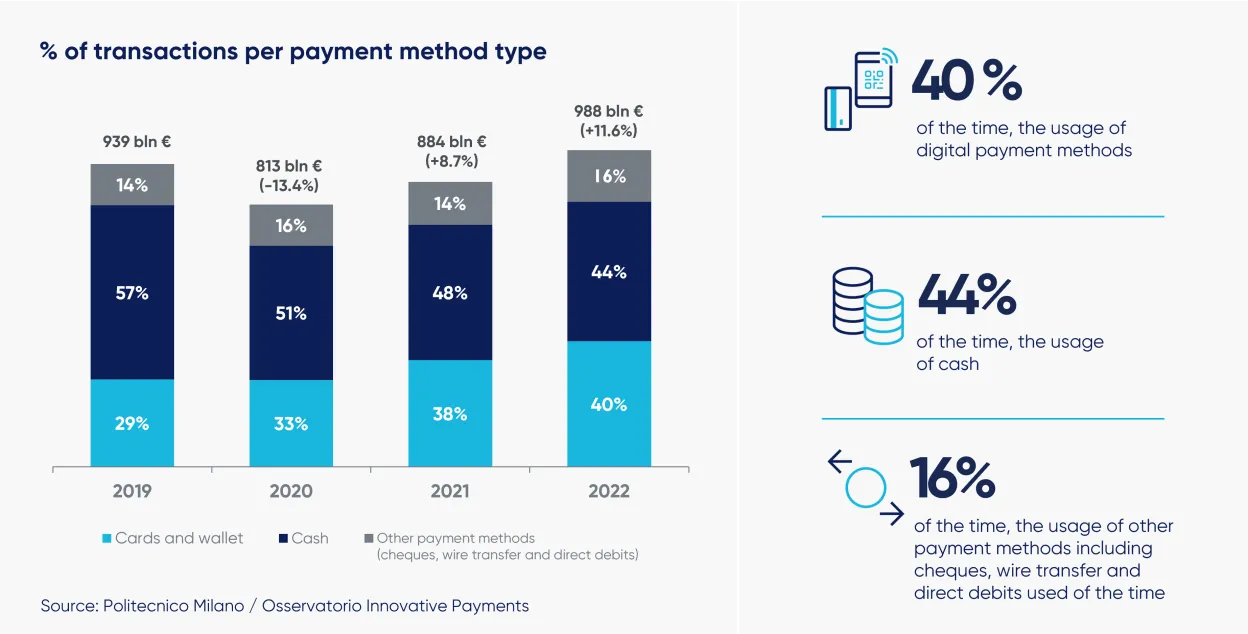

In 2022, the transaction value with digital payment instruments in Italy grew by double digits to reach almost 400 billion euros (+18% compared to 2021). According to ECB data on the number of card transactions per capita recorded in 2021, Italy is one of the countries having seen the greatest growth in the previous year (+33.6%). And growth in the volume of transactions can be seen in all digital payment methods including traditional card types and more innovative methods, such as smartphones and wearables.

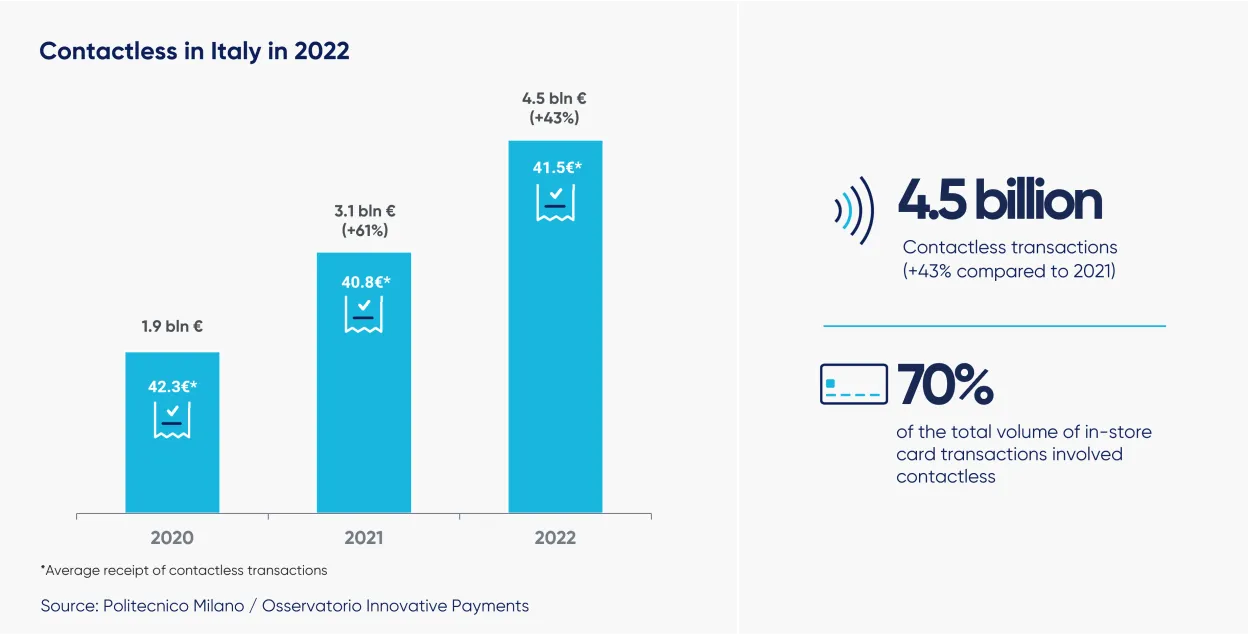

Contactless payment has clearly had a big impact on the growth of digital payments. In 2022, contactless payments value in Italy reached 186 billion euros (+45% compared to 2021).

The contactless phenomenon has been supported by the existence of POS accepting this technology, which was already in place prior to the surge in demand during the covid pandemic. The payments infrastructure has progressed rapidly, and today in Italy there are around 3 million POS in use.

I think the best term to describe it is an inclusive payments infrastructure, and this is becoming even more true now that we have SmartPOS technology coming into place.

The role of the smartphone: a threat or an opportunity?

Globally, the smartphone is leading innovations in the payment sector. Thanks to its availability and optimal user experience when compared with traditional tools, it is increasingly becoming the preferred payment method both for in-store and online payments.

In Asia, super apps such as WeChat and Alipay, have driven the widespread use of mobile payments. While such super apps are not present in western markets, in Italy digital wallets are growing in popularity. Originally developed to support digital payment via a smartphone, digital wallets are increasingly adding new services such as storage of tickets and loyalty cards, and even identity documents. And today it is the latter – digital identity – that is the main focus of interest.

Given the popularity of smartphones, Ingenico’s SoftPOS solution, offering an easy Tap to Pay option, is a perfect fit for the market. That said, I believe it remains relevant to only specific merchant segments and I think we will continue to have POS in large numbers in Italy for a long time.

However, I anticipate that payment will become only a default element of the POS, as the payment device becomes a unique retail tool to manage different services in one, single place. This reflects the transition we are seeing to Android payment terminals, and the broadening range of uses that this solution brings to the POS.

For this reason, I believe Ingenico’s AXIUM Android range is undisputedly the next step for merchants and consumers today, enabling them to do more than just payment with their POS.

Security is of course also of huge importance and is central to Ingenico’s strategy. This is even more important with the introduction of innovative payment methods (including smartphone and wearable tech), which has made us look at these aspects in a more focused and much more delicate way.

Further innovation lies beyond the smartphone

While the smartphone has been the main centre of innovations in recent years, why don’t we look further?

As an example, 'Smart Objects Payment' is growing, especially in relation to smart cars. In the United States there are already about 84 million vehicles online and there is great potential for development. Mercedes has recently announced that it will use Visa’s technology to turn the car into a “payment device”. Vehicles will be enabled through Cloud-based functions, with double authentication, which will allow the completion of different operations, such as recharging the vehicle at an electric charging station. This is an indication of how the payment acceptance tool is evolving in directions that were previously unthinkable.

I believe that the whole world will have to adapt to the Cloud, payment included. The financial community, especially the banking world, will make the decisive switch, embarking in this new world of payment sooner or later. Ingenico has already made this decision, having launched Payment Platform as a Service (PPaaS). And through PPaaS we are helping our customers to seamlessly connect to the cloud-based payment ecosystem. “They design, we connect” is our approach to ensure that our customers are supported at best through this disruptive transition.

Find out more about Ingenico’ Solutions

[1] Statista 2023 evaluations