The technology race is driving rapid change in the world around us: paytech, open banking, AI, ChatGPT, the metaverse, biometrics... How and where we go next in this digital era is up for debate. In a country, such as Poland, where financial innovation is thriving, Android offers huge potential for business growth.

Let’s hear from Waldemar Korwin - Kowalewski, Country Manager for Poland & Baltics at Ingenico, who sees “The future as one of possibility”.

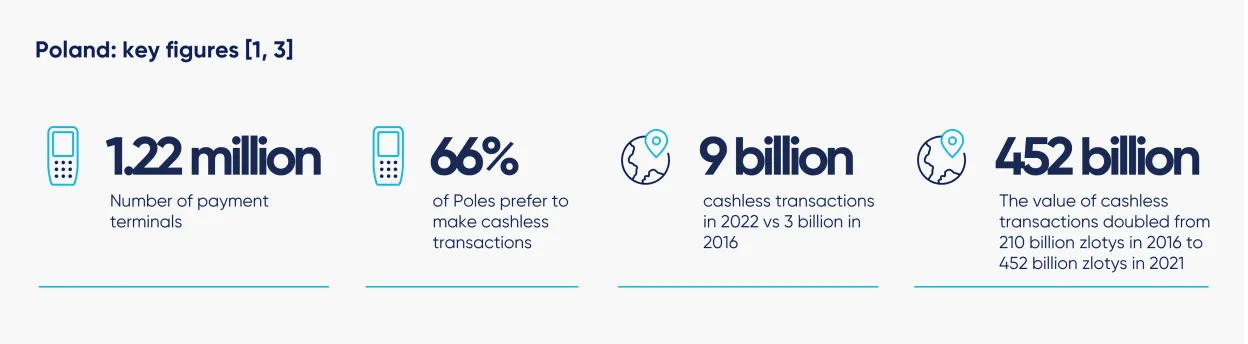

Payment, such an integral part of our daily lives, will no doubt be caught up in much of the change that we will see as technology advances. It’s exciting to think of where we might be in 10 to 20 years’ time if the pace of change continues. Today, Poland’s payment ecosystem is constantly growing, having seen significant growth in digital payments in recent years. The latest figures from the National Bank of Poland place the number of payment terminals at the end of 2022 at 1.22 million. This is reflected in the number of cashless transactions, which have grown from 3 billion in 2016 to 9 billion in 2022[1]. And while cash is still widely used, mostly for day-to-day low-value transactions, payment cards are today the preferred payment tool in Poland, accounting for 38.9% of the total payment transaction volume in 2022.[2]

A place of innovation that will be taken to the next level with…

For me, what is most exciting about Poland today is the many opportunities and new solutions present in the market. A recent report from the FinTech Foundation highlighted that the payment sector in Poland represents 25% of Polish fintech activity. In 2022 there were 74 FinTechs in the payment category – including some of the industry’s most successful companies, such as Blik.[3]

Blik, the leading provider of non-card payment solutions in Poland, has seen impressive growth in POS transactions. In the third quarter of 2022, users made 67 million transactions at a payment terminal, which is 175% more than the same period in the previous year.[4]

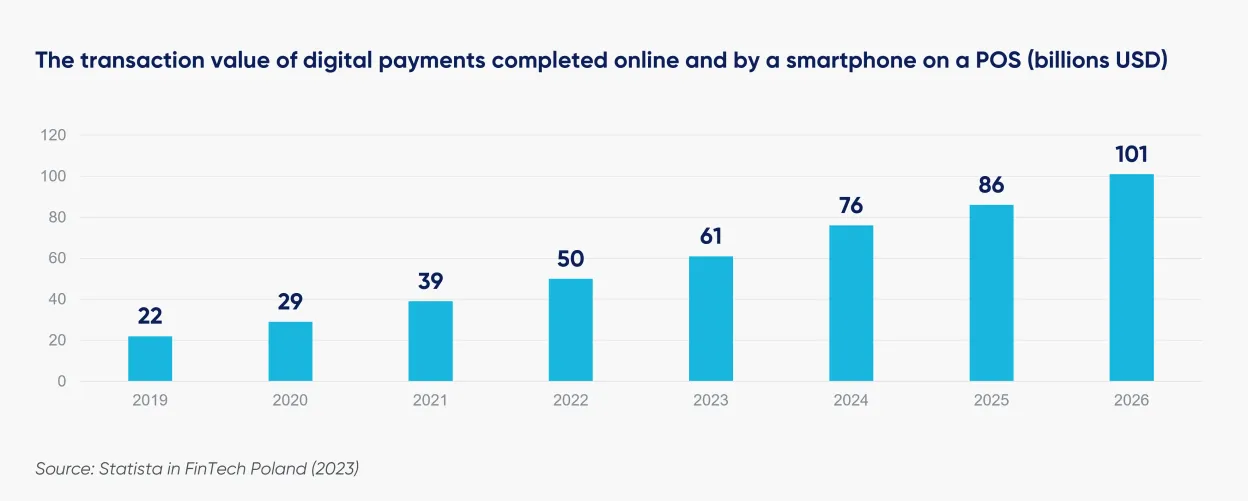

Looking forward and the total value of digital payment transactions (payments for products and services done through the online mode or mobile payments at points of sale [POS] using smartphones) is expected to double from 221m PLN in 2022 to 450m PLN in 2026.[3]

… what Android brings to the market

Alongside this growth, the market in Poland is switching to Android. And with this shift we are seeing increasing innovation in the payments sector.

One of the significant benefits that Android brings is the ability to introduce new value-added services to the POS. The terminal has become a point of engagement and interaction where the customer can do many things. They might make a donation, join a loyalty programme, choose ‘buy-now-pay-later’, opt for home delivery, and so on. These new services can offer additional revenue streams, and so we are seeing considerable interest in this from our customers.

Poland was one of the first countries in Europe to implement the Linux-based retail PIN pad Lane/7000 at one of the biggest Polish retailers. One of the main advantages of the terminal is its 5-inch screen which has been used to display advertisements opening the door to additional revenue streams. Today, the successor is the Android-based AXIUM RX7000, which has enhanced capabilities. It offers new benefits including content personalisation and additional applications. This is alongside professional and innovative terminal fleet management, allowing the acquirer/retailer to control the full scope of terminal activity.

Watch our video to learn more about the RX7000

Android can also help bring efficiencies and reduce the need for peripheral devices. For example, ITCARD in Poland developed a business application for the HoReCa sector that turned the Android POS into an ‘all-in-one’ device. Not only can the POS accept all forms of payment, it can take food orders, add tips, process cashback, integrate with the sales system, and so on. This is saving the merchant time and money, and improving the customer experience. Watch this short video to learn more:

It is no surprise, then, that we are expecting the number of Android terminals in Poland to grow in coming years.

A better tomorrow, together

In such a competitive landscape, we are finding that our customers are looking for additional support with their terminal estate. This gives them more time to focus on their customers, the growth of their business and the addition of value-added services. Terminal as a Service (TaaS) is provided by Ingenico to remove the complexity of managing a terminal estate, covering terminal management, software and solutions in a fully customisable package. It means increased support from Ingenico throughout the terminal lifecycle, including areas such as installation, terminal monitoring and updates, repair and end-of-life recycling.

At the same time, Ingenico is connecting banks and acquirers to Payment Platform as a Service (PPaaS): a cloud-based platform that orchestrates payments, commerce and data services from multiple service providers. Through PPaaS, banks and acquirers can control both their Ingenico fleet and the fleet of another provider. The platform also enables partners to connect to an integrated ecosystem which includes a wide range of ready-to-use applications and solutions such as digital receipts, loyalty programmes, donations and Tap to Pay option. Because now, more than ever, additional revenue streams and modern technology are required for business profitability.

As the world around us changes, not only is Ingenico committed to providing the latest, innovative payment solutions. We are really here to support our customers and ensure the best possible outcome for merchants. And caring for our clients and their business extends to the environment around us, with sustainability being one of Ingenico’s priorities. If we are to have a promising future, what could be more important?

Sources:

[1] National Bank of Poland (2023) Information about payment cards Q4 2022, available online at: https://nbp.pl/wp-content/uploads/2023/05/Informacja-o-kartach-platniczych-Q42022.pdf

[2] Global Data (2022) Poland Cards and Payments: Opportunities and Risks to 2026.

[3] FinTech Poland (2023) ‘How to do FinTech in Poland? Report 2023?’, available online at: https://fintechpoland.com/raport/how-to-do-fintech-in-poland/

[4] Blik (2023) ’324m transactions of nearly EUR 9.1bn, 12m active users – BLIK sums up Q3 2022’, available at: https://blik.com/en/324m-transactions-of-nearly-eur-9-1bn-12m-active-users-blik-sums-up-q3-2022