Begin your journey in 3 easy steps

Frequently Asked Questions

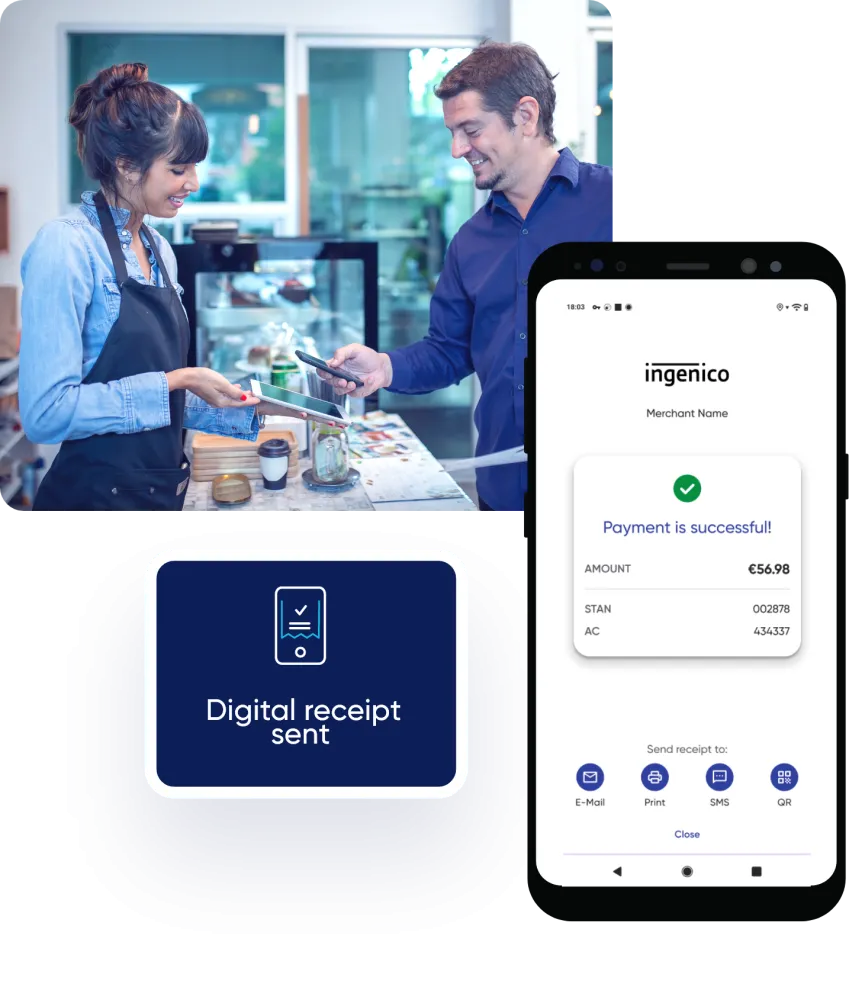

Tap to Pay is a secure and innovative solution that enables merchants to accept contactless payments directly on their smartphones or tablets.By leveraging advanced encryption, tokenization, and compliance with EMV and PCI-DSS standards, Tap to Pay option ensures that sensitive payment data is securely processed. With its robust security measures and ease of use, Tap to Pay offers businesses a flexible, cost-effective, and secure way to accept payments anywhere.

Contact us to learn more.

Yes, many countries and payment networks impose a limit on Tap to Pay transactions to enhance security. For example, in the EU, the limit is typically €50. Transactions above this amount may require PIN entry or other verification methods.

We may request documentation to confirm your company's registration and your authority to represent it. Additionally, we may ask for personal identification documents, such as:

- A copy of your passport

- A driving license

- Any other official photo ID

At Ingenico, the security of your data and your customers' data is our top priority. All data accessed through our SoftPOS Mobile App is immediately encrypted and securely transmitted to our servers. Whether you're using a public or private internet connection, you can rest assured that your data is protected.

If you are a sole proprietor, you can use your personal bank account. However, if you operate as a registered company, the bank account must be in the company's name, not in the name of any manager or officer.

No, you can only connect a bank account that is in the same country where you signed up for Ingenico Tap to Pay solution.